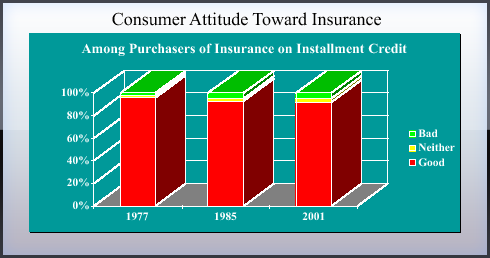

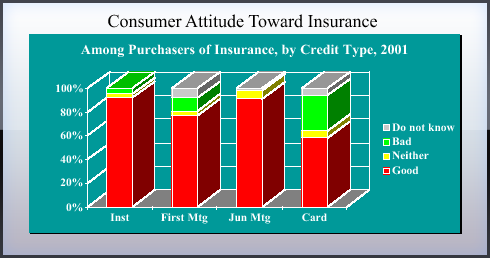

A new survey of consumer attitudes reported by the Federal Reserve Board affirms historically high satisfaction among those who purchase credit insurance and concludes that credit insurance purchasers believe they would be ill-served by any move to restrict credit insurance as an option when they borrow.

The Survey Research Center of the University of Michigan surveyed 1,006 consumers during September and October 2001 for the Credit Research Center of the McDonough School of Business of Georgetown University using a questionnaire designed by Thomas A. Durkin, a member of the FRB’s Division of Research and Statistics.

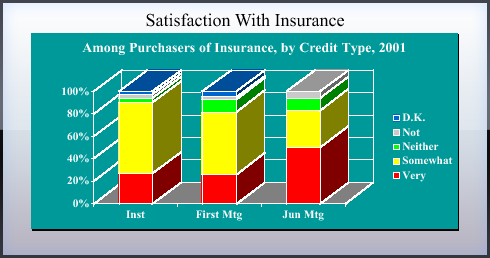

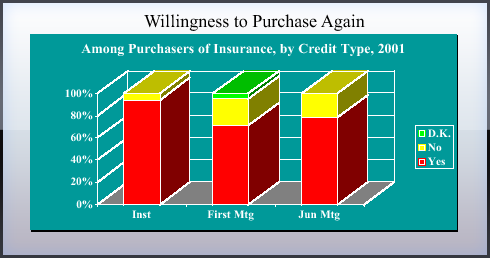

The survey confirms findings of earlier surveys, with up to 90 percent of credit insurance purchasers responding that they are satisfied with credit insurance and would purchase it again when borrowing, and shows again that consumers receive ample notice that credit insurance is a voluntary option to insure loans when they borrow.